Tax time checklist: Are you ready?

Get the most out of your tax return this year. You never know where you might be missing opportunities unless you talk to the experts. Here’s a list to get you started:

- Income

Payment summaries from each employer you have worked for since 1 July 2015 including Centrelink for Newstart, Youth Allowance, Parenting, Pensions etc. - Vehicle and travel expenses

You can claim vehicle and other travel expenses directly connected with your work, however, private travel is not deductible. - Donations

Donations of $2 or more to an approved charitable organisation is tax deductible with a receipt. - Tools and equipment

The cost of tools and equipment used in connection with your work; power tools, computers and software are just some of the deductible items. - Fees

If you pay annual fees for union membership or registration to a professional body you are entitled to claim a deduction. - Uniforms

Purchases of compulsory uniform, protective or occupational-specific clothing are deductible, excluding everyday clothing. - Laundry

Laundry and dry cleaning of work uniforms and clothing. For laundry costs less than $150 you don’t need records to substantiate your claim. - Safety

Safety and protective items such as boots, protective clothing and sun protection. - Self-education costs

You can claim a deduction for self-education expenses if your study is work related or if you receive a taxable bonded scholarship. - Home office

If you use part of your home principally or solely for work purposes, a portion of certain costs can be claimed. - Training

The cost of seminars, courses, conferences and workshops can be claimed. - Meal allowance

If you receive a meal allowance you can claim a deduction up to set ATO limits provided meal expenditure is actually incurred in connection with your work. - Income protection insurance

You are entitled to a tax deduction for insurance premiums paid against the loss of income. This does not include life insurance, unfortunately. - Tax agent fees

Don’t forget that our tax agent fees paid during the year are also an allowable tax deduction.

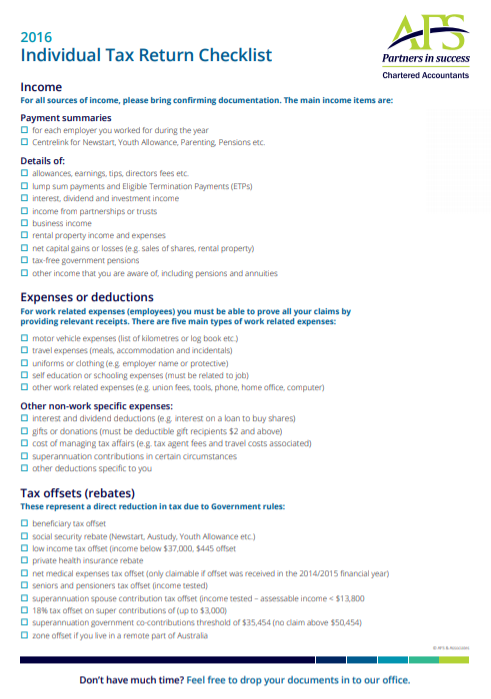

For your benefit we’ve provided a comprehensive checklist to print that’ll have you organised in no time.

The list is not exhaustive of all the deductions available to individuals, rather it is a general guide of common deductions. Please ensure you have evidence for all deductions claimed.

Click the image to view our extensive checklist. If you use the services of AFS & Associates you will receive a significant extension of time to lodge your income tax return beyond the ordinary due date of 31 October.

For any questions or further information, please contact Jacob or any tax services professionals to assist with your tax questions and your 2016 tax return.